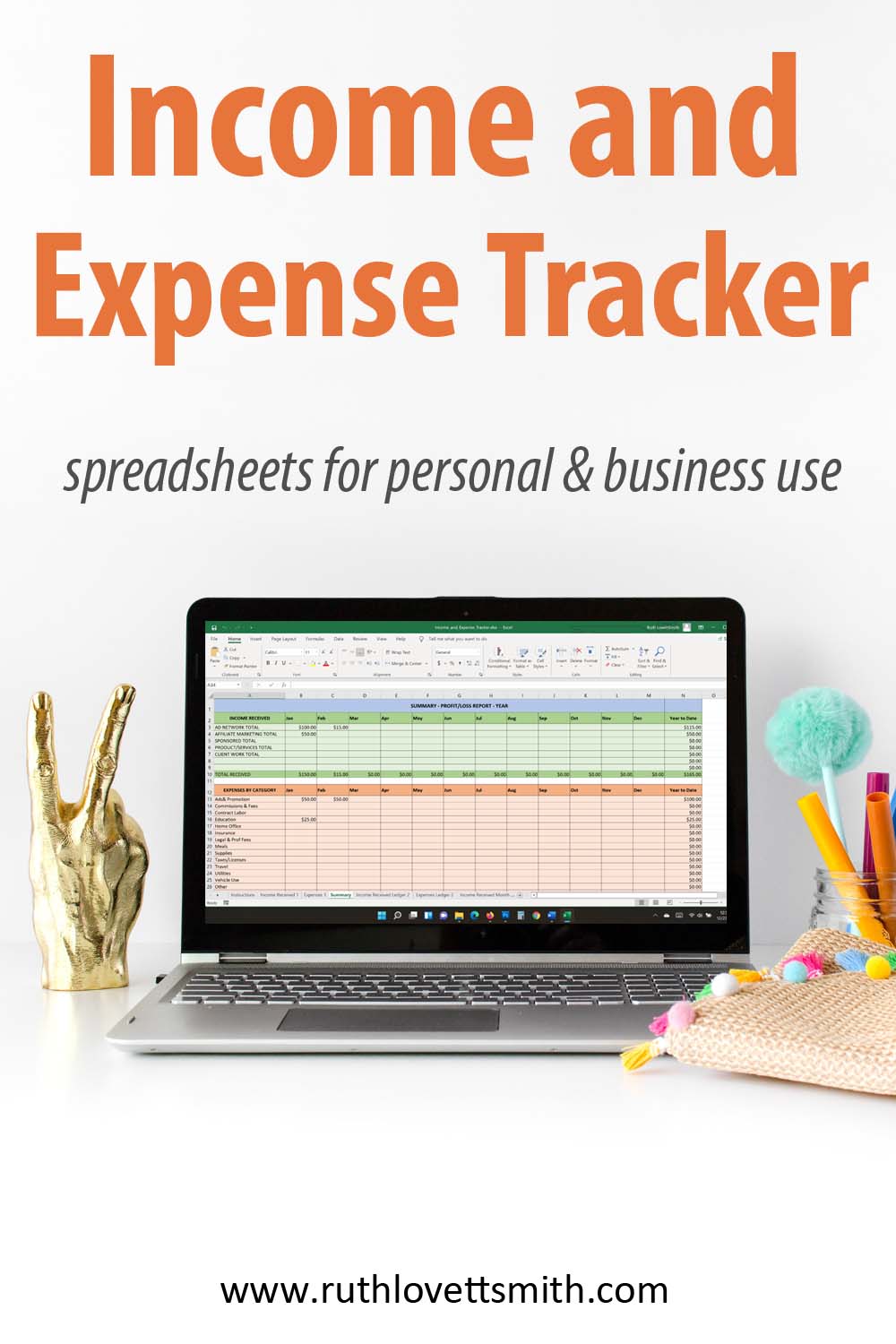

Business Income and Expense Worksheet

This post may contain affiliate links. For more information, see my full disclosures here.

Using a business income and expense worksheet can be a great way to track your finances, as well as create an annual income and expense report. In this post I cover why you need a business income and expense worksheet, and how to track your finances.

Most bloggers, and small businesses, don’t need fancy accounting software. Plus those programs can be super expensive. However, it can be time consuming to create a spreadsheet from scratch. Luckily, I’ve done the work for you!

My business income and expense worksheets come as a series of Excel spreadsheets. In addition, a link to a set of Google Sheets is included, for those who don’t have access to Excel. (You’ll need a gmail email address to access and use the Google Sheets.) The best part – all of the formatting and design work has been completed for you. All you need to do is enter your income and expenses.

Here’s What You Get:

Who is the business income and expense worksheet for?

These business income and expense worksheets are for anyone and everyone! They can be used for business and personal use. Use them to track your business, or personal, expenses and income. Learn where you spend the most money, and where you can save. Use the summary spreadsheet to create an annual income and expense report to help complete your taxes. If you have an accountant, she/he will thank you.

These spreadsheets are perfect for bloggers, freelancers, writers, crafters, artists, and small business owners. I created them because I found that I needed something to keep my own finances organized and in order. However, I didn’t want to spend a lot of money on fancy bookkeeping software.

A spreadsheet option for all of your needs

There are three different income and expense spreadsheet options. This means that anyone, in any field, can use them. You can also edit the spreadsheets to fit your exact needs.

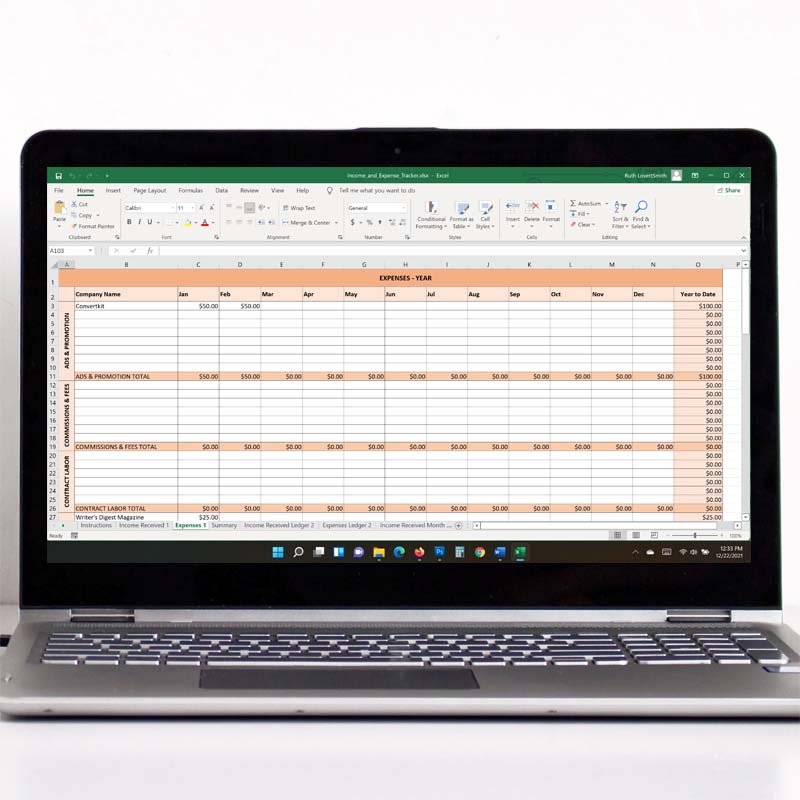

Option One – Annual Income and Expenses by Month and Category

This option is for bloggers and content creators. The income spreadsheet is divided by month, as well as income categories such as advertising, affiliate marketing, sponsored posts, own products/services, and client work.

The expenses spreadsheet is divided by month, as well as common tax categories such as ads and promotion, commissions and fees, contract labor, education, home office, insurance, legal and professional fees, meals, supplies, taxes/licenses, travel, utilities, vehicle use, and other.

Each spreadsheet will tally every category by month, as well as the annual total. In addition, the spreadsheets calculate total monthly income and expenses respectively.

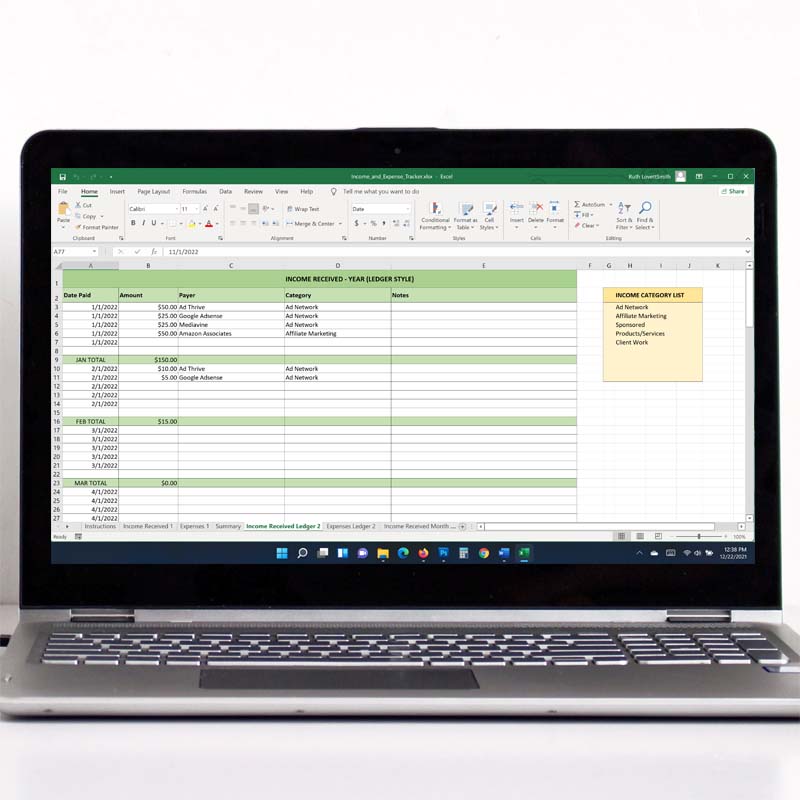

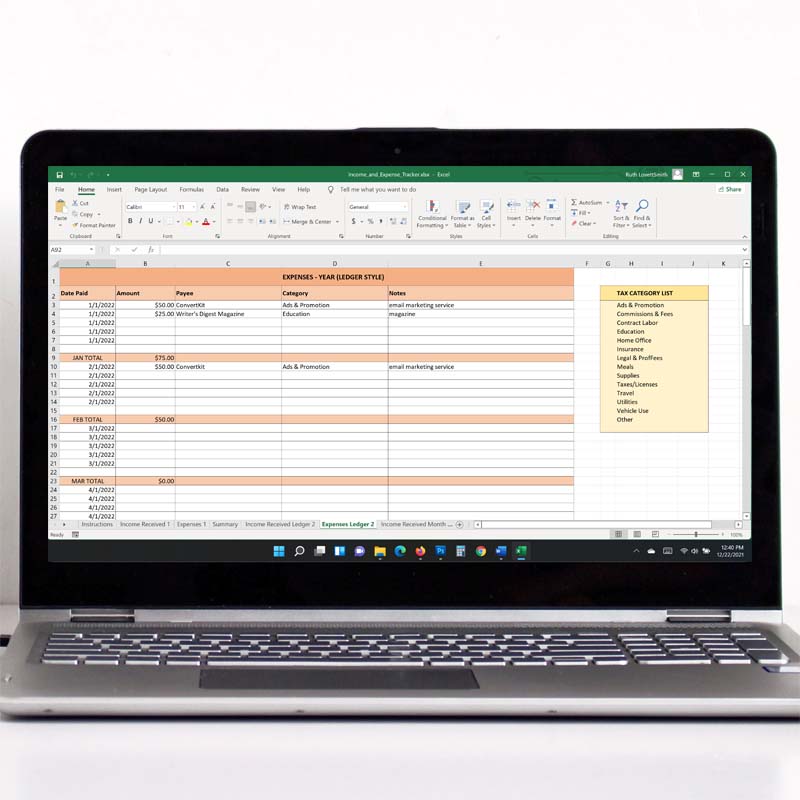

Option Two – Annual Income and Expenses Ledger Style

This option is an annual ledger style option. The date is on the left hand side, by month, and you manually enter the amounts and appropriate categories. This option works best for individuals who have a variety of different income sources and expenses. Or if the categories in option one don’t fit your needs.

Each spreadsheet will tally every month, as well as the annual total. Sample income and expense categories are on the right side of the spreadsheets.

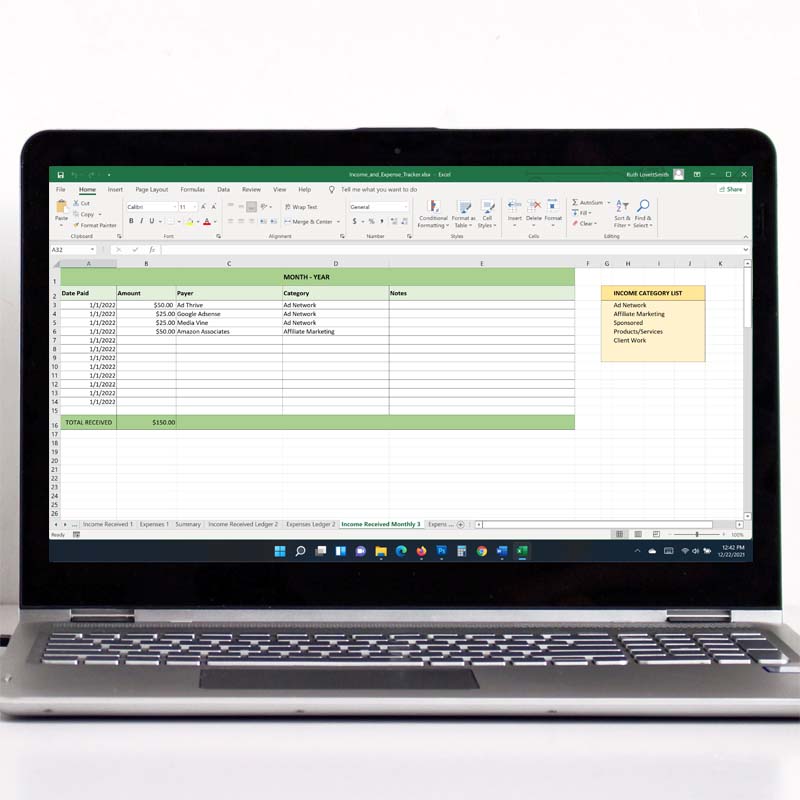

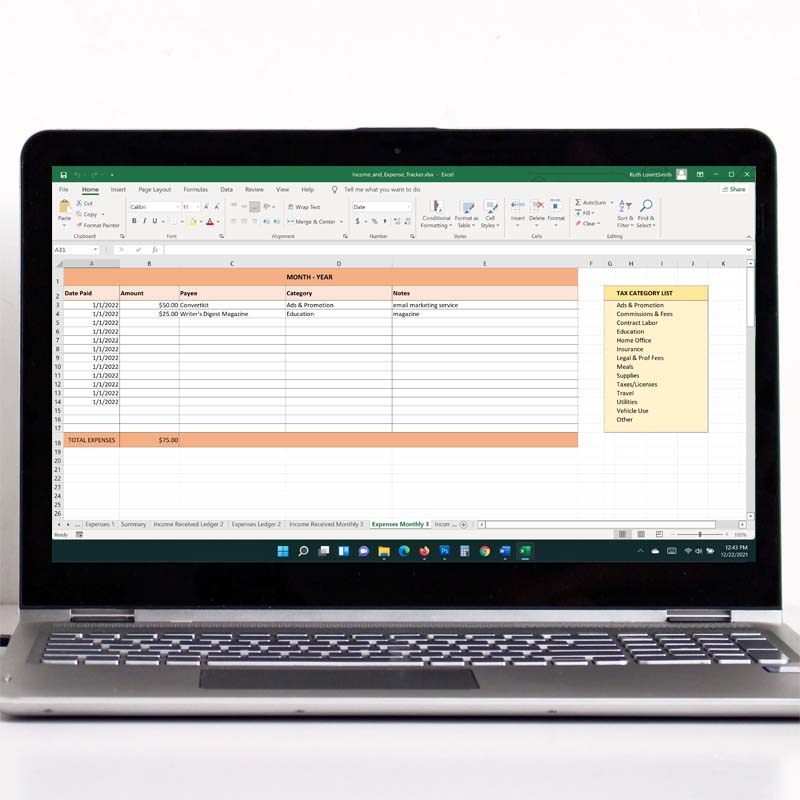

Option Three – Monthly Income and Expenses Ledger Style

This option is similar to option two, except that the spreadsheets are to be used monthly versus annually. This option works best for individuals who expect to have a lot of monthly income and expense entries.

Each spreadsheet will tally the month’s total. Sample income and expense categories are on the right side of the spreadsheets.

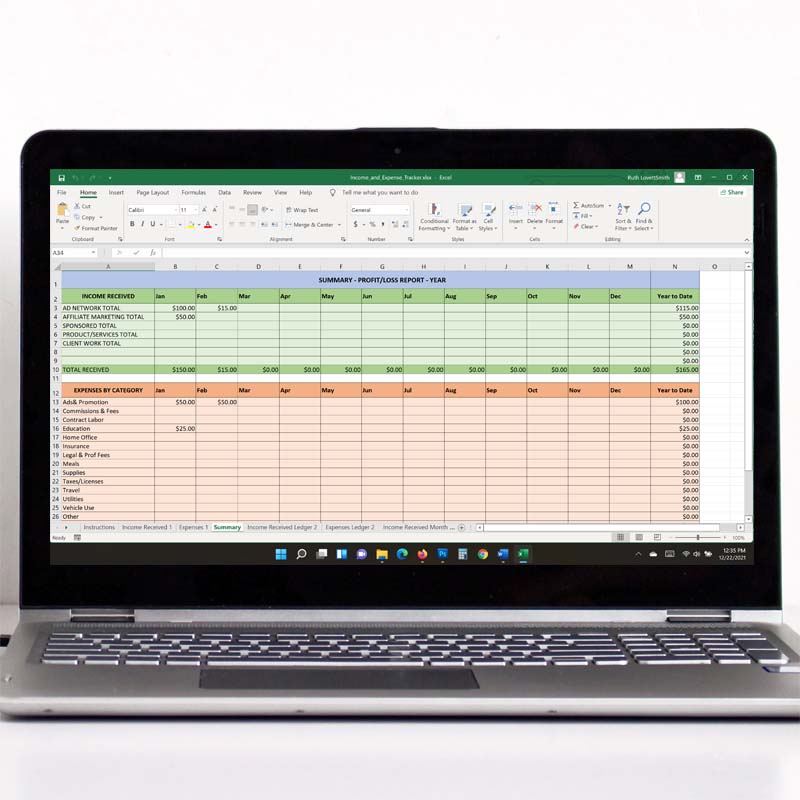

Summary Spreadsheet

The summary spreadsheet is optional. You can use this spreadsheet to create an annual income and expense report, or profit and loss statement.

The spreadsheet will tally total monthly income and expenses, monthly net income, as well as annual totals. You’ll need to manually enter your individual monthly income and expense category amounts. For example, the total income you receive from affiliate marketing in January. Or your total home office expenses for February.

This summary spreadsheet works best with spreadsheet option one, as the category totals are already added for you on those spreadsheets. However, you can also use it with option two and three. You’ll just need to add up your monthly categories first.

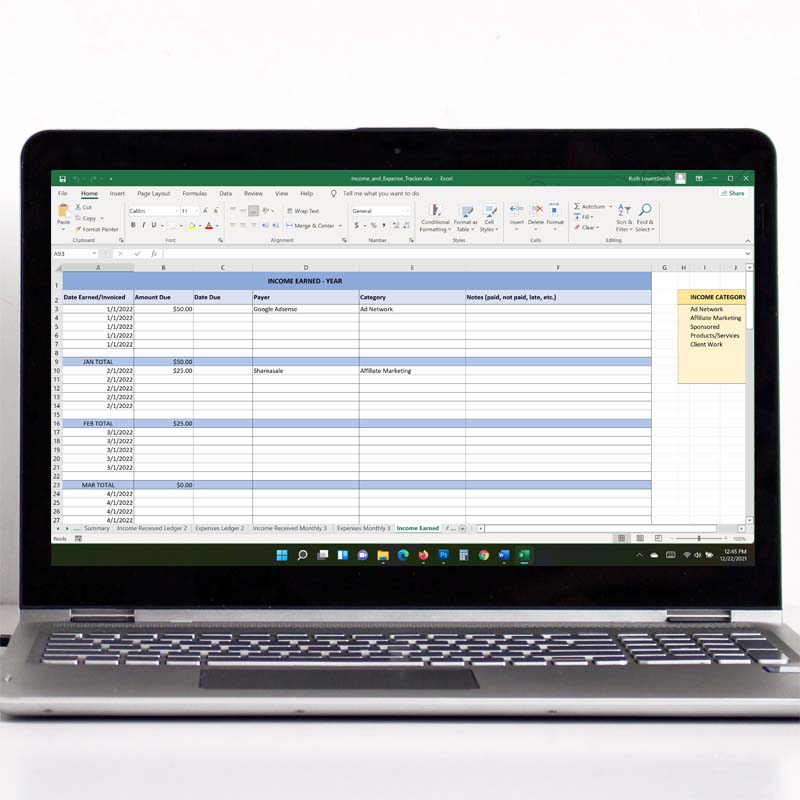

Income Earned Spreadsheet

The optional income earned spreadsheet is for individuals who need to bill clients, for freelancers waiting on payments, or for those of you who would like to track income earned but not yet received.

It’s an annual ledger style, with the dates running down the left side of the spreadsheet. This spreadsheet will tally monthly totals, with an annual total at the bottom.

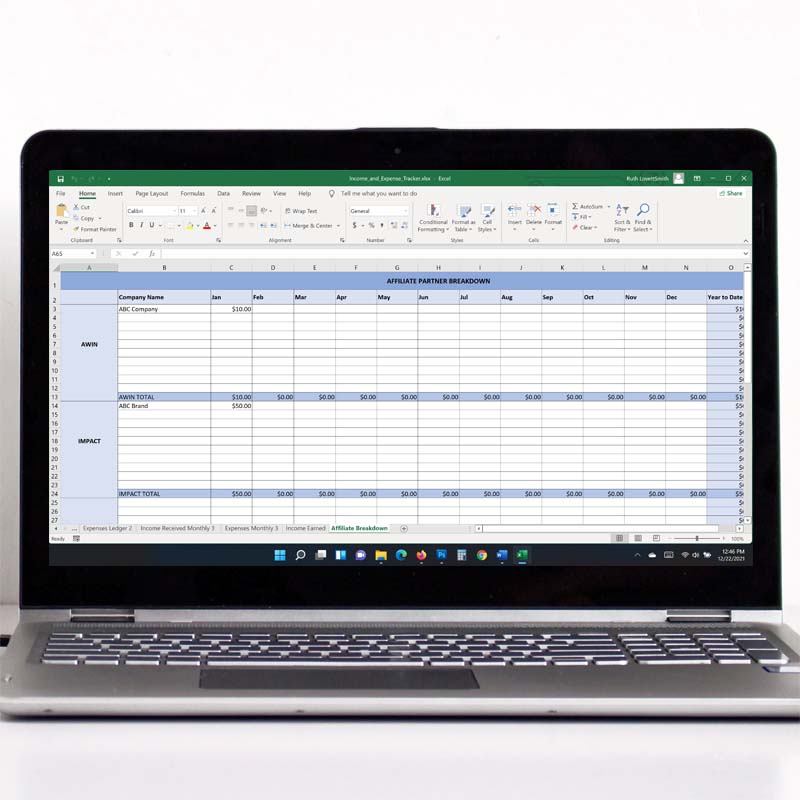

Affiliate Partner Breakdown

The optional affiliate partner breakdown spreadsheet is for individuals who earn money with affiliate marketing. This spreadsheet contains affiliate company categories, such a Awin, as well as space to list out each affiliate partner per company.

This spreadsheet will tally the monthly total of each affiliate company, as well as the annual total of each affiliate partner. You can use this spreadsheet to keep track of income earned or income received. Or make an additional copy of the spreadsheet to keep track of both.

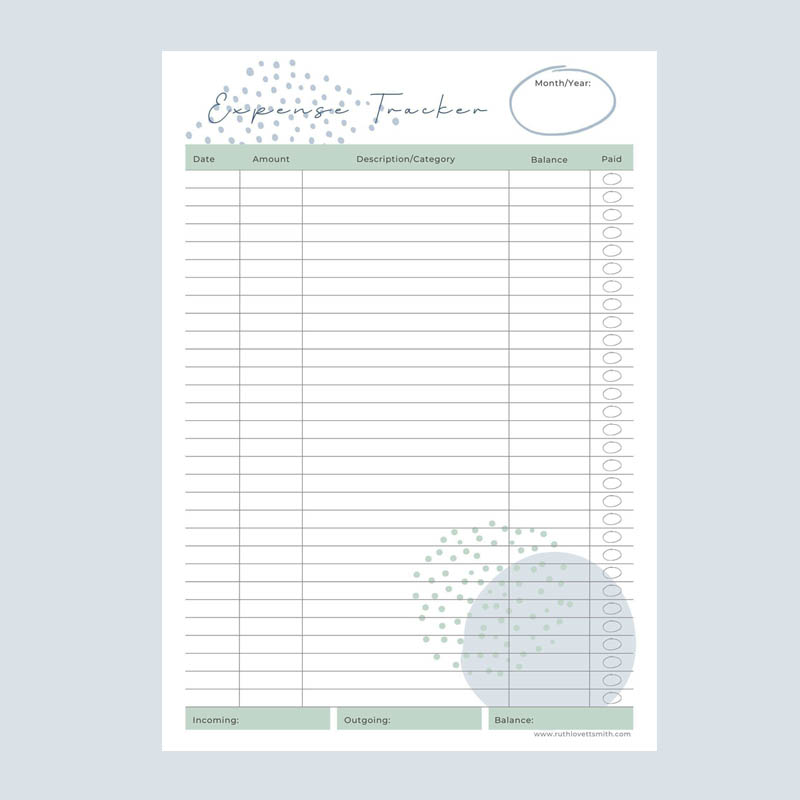

Bonus Expense Tracker Printable

Lastly, you’ll receive a bonus expense tracker printable. It’s a printable worksheet that you can use to keep track of your business, or personal expenses. It’s perfect for you if you prefer to work offline. Simply print out one copy for each month, and put the worksheets into a folder or binder.

Why you need this business and income worksheet

If you want to keep track of your finances, learn where you can save money, and figure out how to earn more money; start tracking your income and expenses today. Many freelancers, and small business owners, are not aware of the numerous business related items that can be written off as tax deductions. If you purchase something that you use for your business, keep the receipt and track the expense with these business and income worksheets.